Carbon Credit Exchanges Are Generated

The carbon credit market is a vital part of global efforts to reduce greenhouse gas emissions. It provides an incentive to private companies that exceed their emission limit to purchase credits to offset their excess emissions, and it creates an opportunity for projects to be rewarded for their climate-related benefits.

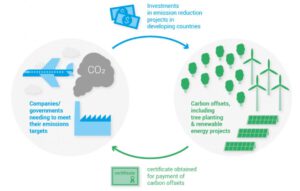

A carbon credit is a financial instrument that represents one ton of CO2e (carbon dioxide-equivalent) reduced by a project. A credit’s value is determined by the type of underlying project, which could be as simple as a forest or wind farm, or it might include a co-benefit such as community economic development and biodiversity protection. The underlying projects are typically independently verified by accredited certification bodies, which are organizations, such as NGOs, that have developed rules for specific types of projects. For example, a forest project will follow standards that specify how to measure the level of CO2 absorption by the new forests, which is used to calculate a specific volume of carbon credit exchange that the project can produce over time.

There are two significant, separate markets for carbon credits: a regulatory market, which is set by emissions caps under so-called “cap-and-trade” regulations at the state and regional levels; and a voluntary market, where companies and individuals can buy and sell their credits for their own purposes. In the regulatory market, carbon credits work like permission slips for emissions. Each company is allotted a number of credits that they can emit each year, and those numbers are reduced over time. If a company produces less than the number of credits it is allowed to emit, it can make up the difference by purchasing carbon credits from another company that has extra space in their yearly allowance.

How Carbon Credit Exchanges Are Generated

In the voluntary market, companies can purchase carbon credits from projects that are certified to meet a range of standards. The credits can then be resold to other companies that have voluntary emission reduction obligations or are looking to meet those requirements. These projects can be as simple as replacing fossil fuel-powered facilities with solar and wind, or as complex as a new power plant that captures and stores CO2 in the ground.

Despite their importance, carbon credit markets suffer from several problems. For instance, a lack of clear price signals leads to confusion about which types of credits are most valuable. Also, high-quality credits are scarce because accounting and verification methods vary, and projects’ benefits, such as community economic development or biodiversity protection, are often undervalued. In addition, suppliers must overcome long lag times to get their credits to the market.

To address these issues, a few players have been trying to improve the quality of the carbon market. To do so, they have created a system known as a carbon credit exchange, which brings together multiple market participants in a central location to facilitate transactions and promote liquidity. These exchanges link supply and demand by linking the four key players in the carbon markets: brokers, retail traders, project developers, and verification providers.